Virginia Tax Relief & Filing Guide: 2025 Updates & Flood Aid

Are you grappling with the complexities of Virginia's tax system, feeling overwhelmed by deadlines and deductions? Navigating the intricacies of state taxes can be daunting, but understanding the system is crucial for every resident, allowing for informed financial planning and ensuring compliance.

Virginia's tax landscape is multifaceted, encompassing income taxes, sales taxes, and excise taxes, alongside local property taxes and business levies. This article provides a comprehensive guide to understanding the key elements of the Virginia tax system, offering insights into how it operates, who is affected, and how to navigate its various aspects.

| Category | Details |

|---|---|

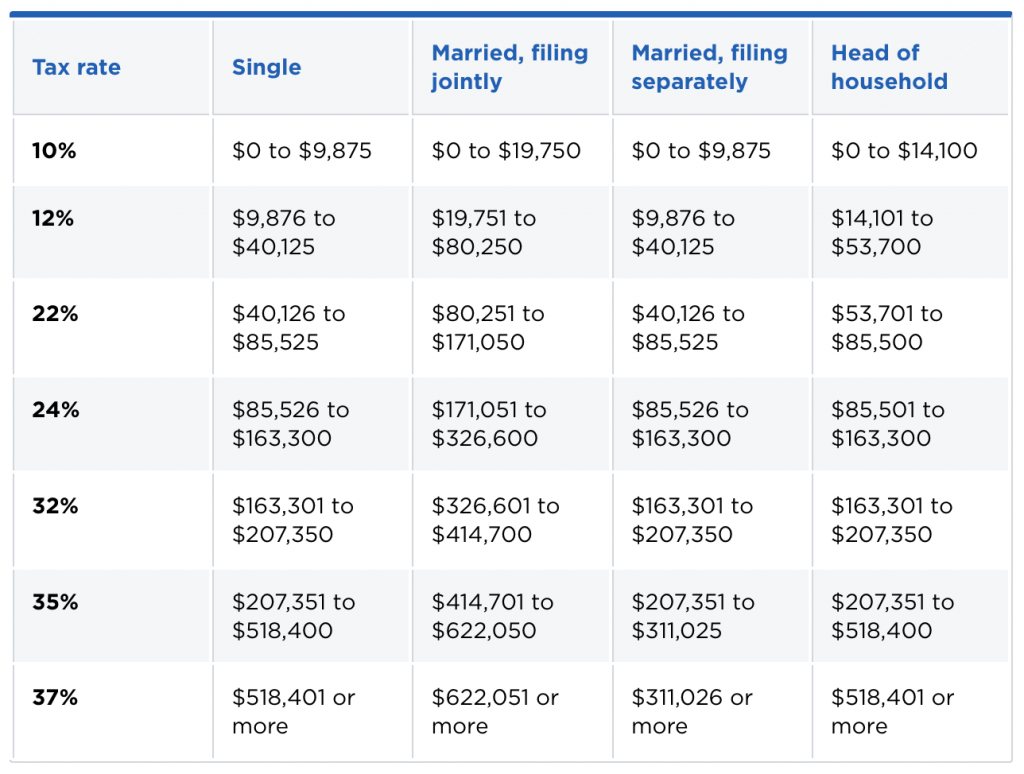

| State Income Tax System | Virginia employs a progressive income tax system, which means the tax rate increases as your income rises. The state offers four tax brackets, with rates ranging from 2% to 5.75%. |

| Tax Brackets and Rates (2025) |

|

| Taxable Income Calculation | When determining your Virginia income tax liability, the state's brackets are applied to your adjusted gross income (AGI) after accounting for any qualifying deductions. These deductions might include itemized deductions, the Virginia standard deduction, and exemptions for dependents. |

| Filing and Payment |

|

| Tax Relief and Assistance |

|

| Sales and Excise Taxes |

|

| Local Taxes | Property taxes, business license taxes, and other levies are imposed by localities within Virginia. |

| Department of Taxation |

|

| Tax Credits and Deductions |

|

| Per Capita Taxes and Debt |

|

| Tax Calculation and Savings |

|

| Resources for Taxpayers |

|

For additional information, please visit the Virginia Department of Taxation website.

Virginia's tax system, while complex, is designed to fund essential public services, from education to infrastructure. Understanding how the system works empowers taxpayers to fulfill their obligations correctly and potentially minimize their tax liabilities through careful planning and the use of available deductions and credits. Whether you're a seasoned taxpayer or new to the Commonwealth, taking the time to understand the rules and regulations can lead to significant benefits.

The Commonwealth's tax system ranks 28th overall on the 2025 rankings, demonstrating a balanced approach to taxation and fiscal responsibility. This ranking considers various factors, including the overall tax burden, the simplicity of the tax code, and the equity of the tax system.

The Virginia Department of Taxation is the primary agency responsible for administering and enforcing the state's tax laws. They provide a wealth of online services and resources to assist taxpayers, from detailed guides on filing individual income tax returns to business tax centers that cater to the needs of Virginia's diverse business community. The departments website offers comprehensive information on a wide range of tax-related topics, including filing deadlines, payment options, and the status of tax refunds. Additionally, the department offers opportunities to apply for historic preservation tax credits, encouraging the restoration and preservation of historic properties across the state.

For those impacted by unforeseen circumstances, such as the February 2025 flooding in Southwest Virginia, the state offers specific tax relief measures. These measures include extensions for filing deadlines and waivers for penalties and interest on tax obligations, providing much-needed support to those facing financial difficulties as a result of the natural disaster. If you have been affected, it is essential to take advantage of these relief programs.

Sales tax in Virginia plays a significant role, with rates varying depending on the locality where the sale or rental occurs and the type of item involved. The sales tax is applied to a wide range of goods and services, including tangible personal property, accommodations, and certain taxable services, unless exemptions or exceptions apply. Additionally, Virginia imposes excise taxes on specific items, such as liquor (20%), wine (4%), and beer and wine coolers. These excise taxes contribute to the state's revenue stream and help fund various public programs.

For those seeking clarity on their tax obligations, the Virginia state tax calculator serves as an invaluable tool. Updated annually to reflect the latest tax rates and thresholds, this calculator incorporates federal tax rates for the current year and will update the state tax tables as soon as they are published. It is a helpful resource for estimating your tax return accurately and can be a great aid in financial planning.

Furthermore, Virginia taxpayers have the option to file their state income tax returns for free if they meet certain eligibility requirements. This allows eligible taxpayers to file both their federal and state returns using free and easy-to-use tax preparation software. If youre a member of the military, you may use Miltax, a software that provides free tax services.

If you're required to file an individual income tax return, you can choose to do so electronically or on paper. When filing, ensure you are aware of the due dates to avoid late filing penalties. If you are unable to meet the filing deadline, you can request an extension. For extension requests, its advisable to send a letter before the first day of the seventh month following the end of your taxable year. Ensure that any checks or money orders for individual tax bills are made payable to the "Virginia Department of Taxation" and sent to the specified PO Box.

Navigating the intricacies of state taxes can be challenging, but understanding the system and utilizing available resources can help you make informed financial decisions and fulfill your tax obligations correctly. By staying informed about the tax rates, brackets, deductions, credits, and filing requirements, you can effectively manage your tax responsibilities and potentially reduce your tax liabilities.

The key to successful tax management in Virginia lies in staying informed, utilizing available resources, and seeking professional advice when needed. By understanding your obligations and taking advantage of available deductions and credits, you can navigate the states tax system with confidence and ensure that you are meeting your responsibilities accurately.

For those who are looking to make payments, the Department of Taxation provides various methods to pay your tax bills. You can make payments for the bills received in the mail or set up a payment plan. Additionally, the Virginia Department of Taxation provides a state tax refund status checker, allowing you to track the progress of your refund.

When calculating your Virginia income tax, it's crucial to understand that the state's income tax brackets are applied to your adjusted gross income (AGI) after accounting for any qualifying deductions. These deductions might include an itemized deduction, the Virginia standard deduction, and exemptions for dependents and business expenses. Using reliable software or certified tax preparers and submitting amended returns can help minimize errors and penalties.

Remember, its always best to consult with a tax professional for personalized advice and guidance. The goal of this article is to help people understand the tax rules in Virginia to make informed decisions.