Virginia Taxes: Your Guide To State Income Tax & More [2024/2025]

Are you prepared for the intricacies of Virginia's tax system? Understanding the diverse range of taxes within the Commonwealth is not just a matter of compliance; it's the bedrock of sound financial planning, crucial for both individuals and businesses operating within the state.

Virginia's tax landscape is multifaceted, encompassing a variety of levies that impact residents and organizations alike. From personal income taxes to local property taxes and business licenses, navigating these fiscal obligations requires a clear understanding of the rules and regulations. The state's approach to taxation is designed to support public services and infrastructure, making informed financial management essential for everyone.

Heres a breakdown of the key components of the Virginia tax system:

| Tax Type | Description | Key Features |

|---|---|---|

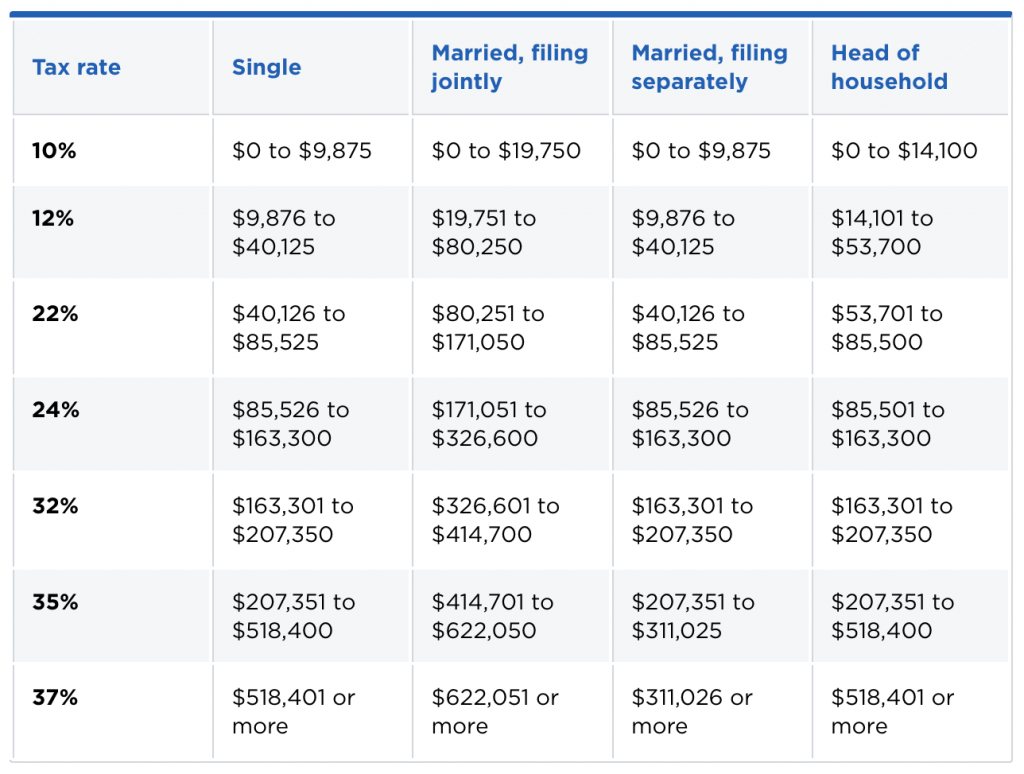

| Personal Income Tax | Tax levied on the income of Virginia residents. | Progressive tax structure, rates ranging from 2% to 5.75%. Income tax calculations for both 2024 and 2025 are based solely on the federal income tax system. |

| Sales Tax | Tax on the sale of goods and services. | State levy of 5.3%, with an additional local rate that can be up to 1%. The grocery tax (1.5%) was repealed in 2023, but local taxes still apply. |

| Property Tax | Tax assessed annually on the value of real estate. | Rates vary by locality; assessed based on real estate market value. |

| Excise Tax | Taxes on specific goods, such as alcoholic beverages and vehicles. | Vehicles are subject to a 4.15% excise tax. Liquor is taxed at 20%, and wine at 4% plus a per-liter tax. Excise taxes also apply to beer and wine coolers. |

| Corporate Income Tax | Tax on the taxable income of corporations. | Virginia has a 6.0 percent corporate income tax rate. |