Key Treasury Management Features You NEED (2024)

In the intricate world of finance, where fortunes are made and lost in the blink of an eye, can a sophisticated system truly become the bedrock of a company's financial well-being? Treasury management systems (TMS) offer a powerful solution, empowering businesses to navigate the complexities of cash flow, liquidity, and risk with unprecedented precision.

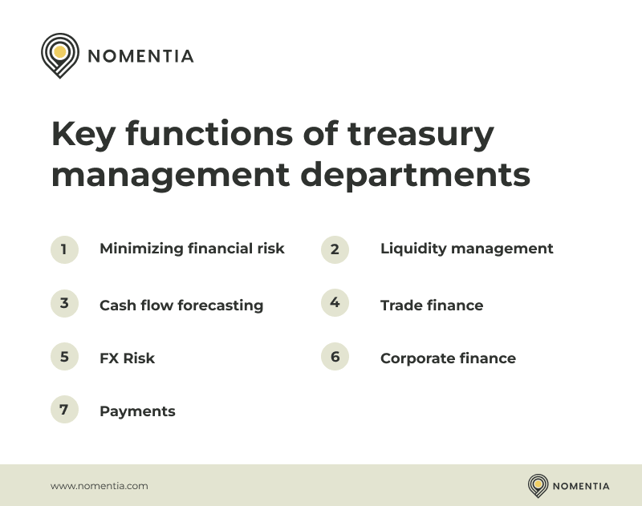

Treasury management, at its core, is the art and science of overseeing a companys financial resources. It's a multifaceted discipline, encompassing everything from the day-to-day management of cash flow to making strategic financial decisions that chart the course for long-term success. Effective treasury management is not merely about balancing the books; it's about strategically deploying financial resources to fuel growth, mitigate risk, and ultimately, enhance shareholder value. The core objectives of treasury management revolve around several key principles. First and foremost is liquidity management, ensuring that a company always has sufficient cash on hand to meet its financial obligations. This includes meticulously tracking incoming and outgoing funds in real time, a critical function of modern TMS platforms.

Next comes risk management, a crucial component in todays volatile financial markets. This involves identifying, assessing, and mitigating various types of financial risks, such as interest rate risk, currency risk, and liquidity risk. Finally, there's the optimization of funding strategies. This involves making informed decisions about debt, equity, and other financing options to maintain financial stability and support organizational growth. The tools of treasury management are diverse and powerful. They include cash and liquidity management software, risk management tools like hedging strategies, investment vehicles, and payment and collection systems. These instruments can be deployed as standalone solutions, or accessed via a single platform known as a treasury management system (TMS).

The landscape of treasury management is often populated by different types of software and systems. A treasury management system (TMS) can be a hub for all your global treasury management operations, helping keep track of just about all the key components of the trade, including transaction management, exposure management, hedge management and accounting, and more. These systems provide integrated tools to optimize working capital, manage cash pools, and prevent cash. The evolution of technology has also introduced treasury management solutions that are like the Swiss army knives of finance, equipped with a range of tools to address diverse needs. They often come with features designed to streamline daily cash management activities and integrate with clients' business systems, empowering treasury professionals to make informed financial decisions.

Keybank's announcement of Keynavigator, a comprehensive digital treasury management platform, is a prime example of this trend. Such platforms enable businesses to manage all their commercial banking services, accounts, and activities in one place, offering a centralized view and control over financial operations. The implementation of a TMS, however, is not without its challenges. A treasury management system often includes upfront costs and initial purchase expenses. Combined with ongoing maintenance and purchase costs, it can become difficult for businesses to realize the full potential of a TMS and optimize their financial management. Then, there's the matter of performance measurement. Treasury stakeholders often grapple with how to measure or assess the (financial) value added by treasurers. Treasury management is a complex field that requires a strategic vision. While plenty of people talk about performance measurement, very few truly apply it.

In essence, treasury management seeks to optimize a company's cash resources and minimize its risks. In doing so, effective treasury management not only helps maintain financial stability but also supports business growth and value creation. As businesses navigate the complexities of the financial landscape, a deep understanding of TMS and its core features becomes an indispensable asset. Whether you are managing a small business or a multinational corporation, staying ahead in today's competitive market demands a firm grasp of these principles and tools. Understanding these features is crucial for staying ahead in todays competitive market. A strong TMS includes the following core features: tracking incoming and outgoing funds in real time, centralizing payments and standardizing workflows, enabling companies to forecast cash flows accurately, and optimizing working capital.

| Feature | Description | Benefits |

|---|---|---|

| Real-Time Tracking of Funds | Monitoring incoming and outgoing cash flows as they happen. | Provides immediate visibility into cash position, allowing for proactive decision-making. |

| Centralized Payments & Workflows | Consolidating payment processes and standardizing workflows. | Improves efficiency, reduces errors, and enhances control over payment processes. |

| Cash Flow Forecasting | Accurately predicting future cash inflows and outflows. | Enables better working capital management, investment decisions, and proactive risk mitigation. |

| Risk Management | Identifying, assessing, and mitigating financial risks. | Protects against losses from interest rate fluctuations, currency changes, and other market risks. |

| Liquidity Management | Ensuring sufficient cash is available to meet financial obligations. | Maintains financial stability, supports operational needs, and facilitates growth opportunities. |

Treasury management solutions are like the swiss army knives of finance. Consider the impact of a tool that can control cash, mitigate risk, and streamline payments with seamlessly orchestrated data that scales with your business. It's essential to understand the core features that will benefit your financial operations. Each feature is designed to address specific needs within treasury management, enhancing overall efficiency and effectiveness. The biggest benefits of using treasury and risk management in SAP S/4HANA, for instance, include innovative apps and services that enhance the value of the treasury management systems. The core principles of treasury management are interwoven. Liquidity management provides the foundation, risk management protects the company from unforeseen losses, and optimizing funding strategies ensures long-term financial health.

By employing these tools and understanding the key objectives of treasury management, companies can achieve greater financial control, mitigate risks, and position themselves for sustained growth. In a world where financial volatility is the norm, treasury management is no longer a luxury; it's a necessity. The insights into cash flow, liquidity, and risk management that are inherent in todays TMS offerings are transforming how businesses operate. Consider the impact of effectively managing working capital, managing cash pools, and preventing cash shortfalls. These seemingly simple objectives underpin the financial health and stability of any organization, irrespective of size or industry. The ongoing evolution of the financial landscape is a challenge that can be successfully met through the proactive adoption of treasury management principles and the effective deployment of available tools.

The choice between different treasury management solutions, in the face of a rapidly evolving market, is crucial. Companies like KeyBank, with their Keynavigator platform, offer payment solutions and digital tools that streamline commercial banking services. These tools integrate with existing business systems, allowing treasury professionals to make more informed and timely financial decisions. Explore SAP S/4HANA's market risk, credit risk, and portfolio analyzers to better understand the range of available solutions and to ensure a seamless integration between treasury and other systems. A forward-thinking approach includes not only the adoption of a TMS but also the continuous evaluation of its performance. Performance measurement is often overlooked, but without it, the true value of treasury management remains hidden. The ability to measure the impact of treasury decisions is what separates successful companies from those that struggle.