Treasury Management Systems (TMS): Solutions & Features | [Keyword]

In today's complex financial landscape, where every penny counts and agility is paramount, how do businesses ensure their financial operations are not just surviving, but thriving? The answer lies in robust treasury management, a strategic discipline that can unlock significant value and drive sustainable growth.

Our team of experts is dedicated to working with you to understand your unique payment processes. We deliver tailor-made solutions to help you reduce costs, increase working capital, and dramatically improve process efficiencies. A treasury management system (TMS) is a linchpin for many companies' financial success, a crucial element that can determine financial health. Treasury management is vital for financial stability and growth. It is a dynamic process that necessitates continuous adaptation and improvement.

Understanding the specific needs and objectives of an organization is critical for success. Treasury management systems (TMS) typically offer a range of features to help manage an organizations financial operations. Efficient use of automated tools and interfaces minimizes operational risk.

Here's a look at the core components that are essential:

| Feature | Description | Benefits |

|---|---|---|

| Cash Management | Real-time visibility into cash positions, forecasting, and optimization of cash flow. | Improved liquidity, reduced borrowing costs, and better investment decisions. |

| Liquidity Planning | Strategic management of an organization's financial assets, liabilities, and liquidity. | ensures funds are used in the best possible way |

| Risk Management | Identification, assessment, and mitigation of financial risks, including interest rate, foreign exchange, and credit risks. | Protection against financial losses, improved financial stability, and compliance with regulations. |

| Payments | Centralized and automated payment processing, including domestic and international payments. | Increased efficiency, reduced errors, improved control, and cost savings. |

| Bank Account Management | Administration of bank accounts, including account opening, closing, and maintenance. | Streamlined banking relationships, improved visibility, and reduced administrative burden. |

| Debt and Investment Management | Management of debt and investment portfolios, including tracking payments, maturity dates, and portfolio optimization. | Improved investment returns, reduced debt costs, and better portfolio management. |

| Reporting and Analytics | Generation of reports and analysis of financial data to support decision-making. | Improved visibility, better insights, and data-driven decision-making. |

Treasury management solutions empower businesses to take control of their financial operations with precision and confidence. Several options are available, each with its strengths and weaknesses. Keybank offers payments solutions for healthcare, real estate and the public sector. Kyriba provides treasury management, risk management, payment processing, and working capital management to maximize company liquidity.

A treasury management system (TMS) is a solution that helps businesses manage cash flow, liquidity, payments, and financial risk. For many large enterprises, a treasury management system (TMS) serves as the central hub of their treasury operations, connecting external systems like banks and ERPs with internal finance workflows. By tracking incoming and outgoing funds in real time and centralizing payments and standardizing workflows, TMS solutions help improve efficiency and reduce the risk of errors.

When selecting a treasury management system (TMS), its essential to understand the core features that will benefit your financial operations. Each feature is designed to address specific needs within treasury management, enhancing overall efficiency and effectiveness. Common key functions and features of treasury management systems. The risk management capabilities of treasury management software also help identify and mitigate financial risks such as interest rate and foreign exchange risks that may use hedging strategies. Supporting debt and investment management, TMS solutions optimize portfolios and track payments and maturity dates.

The benefits of a treasury management system are manifold. A TMS that can be used for investment management. It enables companies to forecast cash flows accurately and optimize working capital. Inaccuracy in treasury management processes can lead to sizeable consequences. Efficient use of automated tools and interfaces minimizes operational risk. Our treasury cash management solutions offer the feature of bank account management that levels all these basic treasury functions. Treasury management refers to planning and organizing the financial aspects of the company to ensure funds are used in the best possible way, liquidity is maintained, the overall cost of funds is reduced, and operational and financial risks are tranquilized.

Treasury and risk solutions 6 treasury operations fis treasury solutions can help minimize repetitive processes that can introduce errors. Four key areas within a treasury department are enhanced by the use of fis treasury. Benefits from Bloomberg's unmatched financial market insights. Treasury management is the strategic management of an organizations financial assets, liabilities, and liquidity to achieve specific goals. This post takes a closer look at one of those options: the treasury management system (TMS). Kyribas treasury management solution offers cash management, liquidity planning, financial transaction processing, and the ability to manage banking.

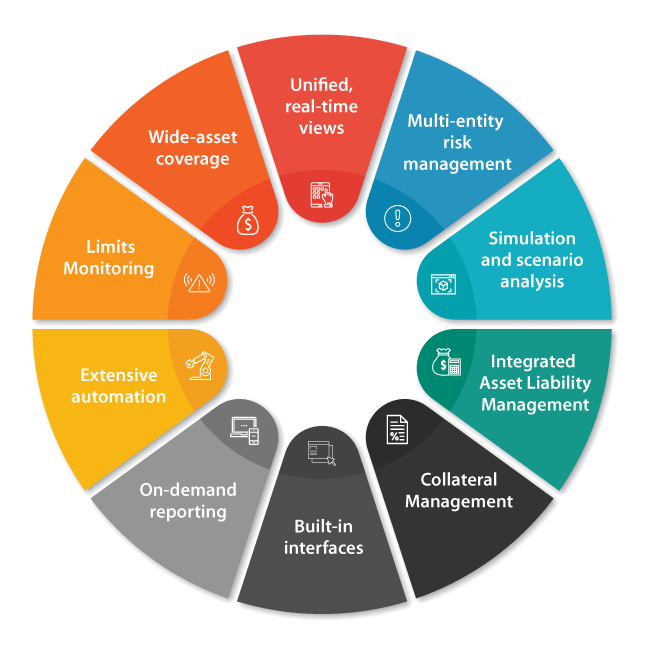

Here are the top features to look for: Common features of TMS solutions. While different TMS platforms offer unique spins on functionality, certain features are fairly universal. Not a true treasury management system despite often getting classified as one. Its primarily an enterprise receivables platform that just so happens to also include basic cash forecasting. Unfortunately it still lacks key treasury management features like banking solutions, credit offerings, working capital options, and AP functionality. Deluxe treasury management solutions offers a treasury management systems. A treasury management system, or a TMS is an integrated software solution designed to centralize and automate core treasury functions, including cash management, forecasting, financial risk management, payments, bank account administration, and regulatory compliance.