ExxonMobil Credit Card: Manage & Pay Online | Tips & Info

Are you tired of juggling multiple accounts and seeking a streamlined approach to managing your fuel expenses? Discover the power of the ExxonMobil credit card and unlock unparalleled convenience and savings for your personal and business needs.

In today's fast-paced world, efficiency is paramount. The ExxonMobil credit card offers a suite of features designed to simplify your financial life and enhance your control over fuel-related spending. From online account management to exclusive rewards programs, the benefits are tailored to meet the demands of modern consumers and businesses alike. With just a few clicks, you can manage your account, track your spending, and take advantage of exclusive offers. Whether you're a personal user seeking convenience or a business owner looking to optimize fleet expenses, the ExxonMobil credit card presents a compelling solution.

This exploration delves into the various facets of the ExxonMobil credit card, providing a comprehensive overview of its functionalities, benefits, and how it can revolutionize the way you handle your fuel expenses. We will navigate through account management, payment options, rewards programs, and other key features, offering insights that will empower you to make informed decisions and maximize the value of your card.

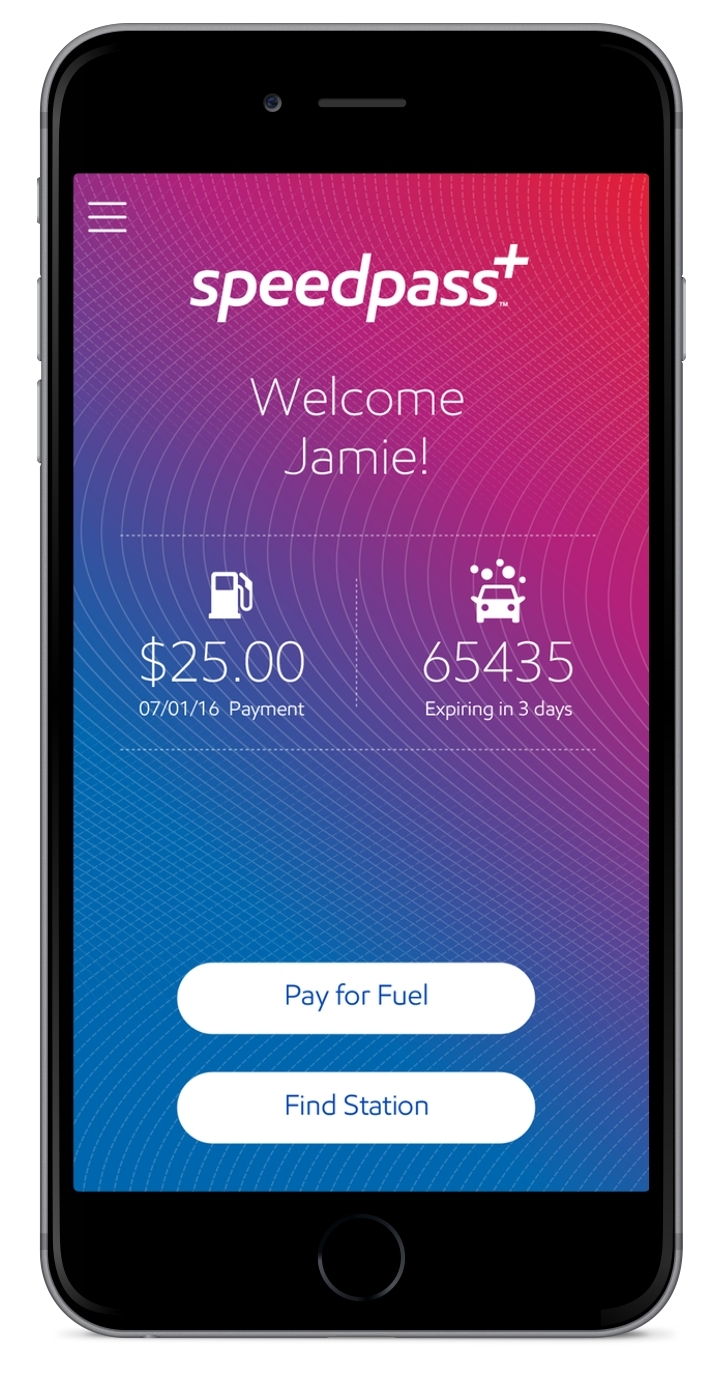

Let's delve into the world of ExxonMobil credit card, exploring the core functionalities and benefits it offers. One of the primary advantages is the ease with which you can manage your account. You can access your account online at any time, from any device. This means you can review your activity, check your balance, and manage your alerts all from the comfort of your home or on the go. Moreover, you can easily pay your bill online, choosing to pay in full each month or make the minimum payment. Citibank, N.A., facilitates these online bill payments, providing a secure and reliable platform for transactions. By authorizing online bill pay, you authorize Citibank, N.A. to initiate electronic payments from your bank account. This authority remains in effect until canceled in writing, providing you with control over your financial interactions. You can also sign up for the ExxonMobil Direct Debit+ program to save on gas by linking your bank account and paying via the Gas Rewards app, streamlining your payment process.

The ExxonMobil Rewards+ program offers a fantastic opportunity to earn gas rewards. By simply logging into your account, you can start accumulating points for savings on fuel, drinks, snacks, and more. This program adds an element of fun to your everyday spending and helps you save money on your regular purchases. You can also take advantage of your new online account by managing your alert settings, downloading statements, or enrolling in autopay, enhancing your account management experience. The ability to automate payments through autopay provides a seamless way to stay on top of your bills and avoid late fees. You're in control of your finances with a variety of payment options, ensuring a smooth and hassle-free experience.

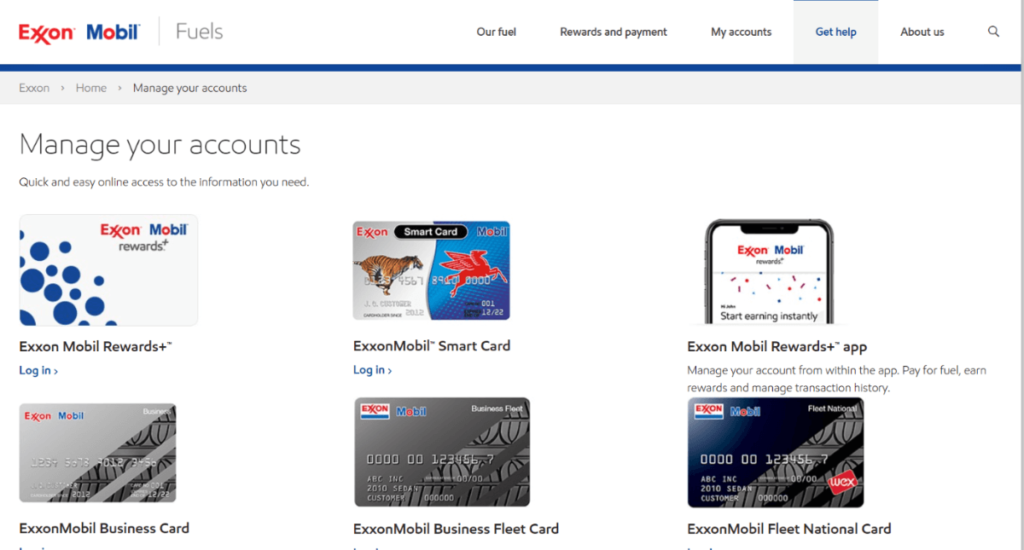

Managing your ExxonMobil gas card accounts is now more accessible than ever. You can review your activity and check your balance for both personal and business needs. ExxonMobils business gas cards are designed to help you take charge of fueling costs, whether for personal use or commercial endeavors. You can reduce one of your biggest business expenses with automatic accounting, detailed reports, and powerful tools for savings. The convenience extends to payment options, too. The ability to pay your bill online, in addition to a variety of other payment methods, gives you greater control over your finances. The option to set up automatic payments through Citibank further simplifies your payment process, and gives you the peace of mind that your bills are paid on time.

The ExxonMobil credit card provides comprehensive account management capabilities. You can manage your alert settings, download statements, and enroll in autopay and paperless billing. These features enable you to stay informed about your account activity and easily access your financial records. You can track payment delivery and history, ensuring that you always have a clear view of your transactions. With anytime access through the Doxo iPhone and Android apps, you have instant control over your account from anywhere. This level of accessibility is especially valuable for those who travel frequently or need to manage their finances on the go.

When it comes to fuel rewards, the ExxonMobil Rewards+ program stands out. Joining the program allows you to earn points on your purchases, which can then be redeemed for savings on fuel, drinks, snacks, and more. This rewards program is an excellent way to get more value out of your regular spending. To ensure a smooth experience, the program is available at participating Exxon and Mobil service stations. ExxonMobil and Mobil also offer a wide variety of fuel and lubricant products. The fuel and lubricant products are reliable and trusted. The brands commitment to quality ensures that youre using dependable products.

When it comes to payments, ExxonMobil credit card offers a range of convenient options to cater to different preferences. For those who prefer the convenience of online payments, you can log in to your online account and find the payment button. From there, you can choose how much to pay, when to pay it, and where the payment is coming from. Citibank allows cardholders to set up automatic payments, too, streamlining the process and ensuring that bills are paid on time. You can pay for free with a linked bank account. Additional payment methods may incur fees. This flexibility allows you to manage your finances in a way that best suits your needs.

For businesses, ExxonMobil gas cards offer tools to take charge of fueling costs. The business gas cards offer automatic accounting, detailed reports, and powerful tools for savings. These features can help reduce one of your biggest business expenses and improve your financial management. Fleet cards offer specialized solutions. For those looking for fleet management and fuel management, Wex offers benefits and services. This simplifies fuel management, with options for corporate payments and corporate cards. The cards are accepted at a wide array of U.S. gas stations, making it convenient for drivers to fuel up. You can maximize rebates at Exxon and Mobil, further increasing the benefits of using the card.

The company uses cookies on its digital payment website to enhance your experience. By using the service, you consent to the use of cookies. If you want to receive payments without all the detail pages attached, you can submit an online request and ask for the "no statement" option. Payments will be mailed or direct deposited, and details will be available on the online system. It is important to know customer service call center hours of operation, to address any immediate concerns.

For overnight delivery or express payments, ExxonMobil offers efficient processing options. Save up to 6 cents per gallon at over 12,000 Exxon and Mobil locations. This can lead to considerable savings, especially for businesses with large fuel consumption. ExxonMobil provides a direct debit+ option, a convenient way to pay for gas. By linking your bank account and paying via the gas rewards app, you can save time and effort. It is important to note that additional fees may apply for other payment methods.

The ExxonMobil credit card offers numerous advantages for both personal and business use. From convenient online account management and exclusive rewards programs to flexible payment options, it provides a comprehensive solution for managing fuel expenses. Whether you are looking to streamline your personal finances or optimize your business operations, the ExxonMobil credit card can help you achieve your goals. By taking advantage of the various features and benefits, you can gain greater control over your spending, save money on fuel, and enjoy a seamless and rewarding experience.